Losing your job is a very stressful experience, but finding a new one is no walk in the park either. Yet, once you get over the initial shock, it’s worth knowing that there’s light at the end of the tunnel. As the Chinese say, a crisis is made up of danger and opportunity, and this may be the unexpected bridge that will take you into a brighter future.

Fortunately, there’s a number of mechanisms in place to ensure the transition to your new job is as smooth as possible. The Canadian government offers economic relief to those who qualify and need it.

In this article, we’ll tell you how Employment Insurance (EI) regular benefits work in Canada and how you can apply to receive them.

WHO CAN APPLY?

The regular benefits offered by Employment Insurance (EI) in Canada are aimed at providing temporary financial support to those who lost their job through no fault of their own and are actively seeking employment.

In order to be eligible for unemployment compensation, the following conditions must be met:

- You have lost your job through no fault of your own (involuntary unemployment)

- You have not worked and not received wages for at least 7 consecutive days

- You have worked the required number of insured hours in the last 52 weeks or since the last claim (whichever is shorter)

- You’re ready and available for employment

- You’re actively seeking employment (you must keep a written record of employers you contact, including when you contacted them)

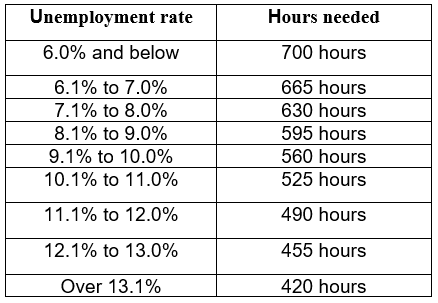

The amount of hours worked required to receive benefits depend on the regional unemployment rate in your area; the higher the unemployment rate, the lower the number of hours worked needed for the qualifying period. However, you’ll need a minimum of between 420 and 700 hours to qualify for benefits. For example, in a region with an unemployment rate below 6%, you must have worked 700 hours during the qualifying period to be eligible for unemployment compensation. Whereas in a region with an unemployment rate of over 13%, you’ll only need to have worked 420 hours to be eligible.

Have a look at the table below to get an idea of the number of hours you need to have worked according to the unemployment rate in your area:

Please note: If these conditions don’t apply to you, we suggest you use this benefits finder to check what help is available to you.

WHAT CAN I EXPECT TO RECEIVE?

The amount you can expect to receive will be proportional to what your income used to be. In general, it is equivalent to 55% of the average weekly income earnings subject to contributions, up to the maximum limit of $595 per week. It is possible to accumulate unemployment compensation with part-time work. In this case, 50 cents are deducted from the weekly benefit amount for each dollar earned.

The addition of the compensation and income cannot exceed 90% of the employee’s previous weekly earnings (approximately four and a half days of work). Beyond this limit, one dollar is deducted from the amount of the compensation for each dollar received.

Please note: the allowance will be stopped if the employee works full time per week (regardless of the amount of earnings received).

The length of compensation ranges from 14 to 45 weeks and depends on the regional unemployment rate and the number of hours worked during the 52 weeks or since your last benefits claim. For the same length of affiliation, the higher the unemployment rate, the longer the length of compensation.

For example, a person who has worked 700 hours will be eligible for 14 weeks of benefits if they live in a region with an unemployment rate of less than 6%, while they’ll be eligible for 36 weeks of benefits in a region with an unemployment rate of more than 16%.

HOW CAN I APPLY?

If you meet the requirements, you can apply online. We suggest you do it as soon as possible to take full advantage of your rights. If you don’t apply within four weeks of your last day at work you may not qualify.

Completing the electronic form will take about 60 minutes. You will need to provide the following information:

- You Social Insurance Number (SIN)

- Mother’s maiden name

- Mailing address

- Bank information and account number

- Your employers’ contact information for the past 52 weeks, dates of employment, and reasons for separation from all of them

- Your detailed version of the facts regarding the termination of each job

- Dates and wages received for each of the 52 weeks of earnings

WHAT HAPPENS NEXT?

Once your application has been validated, you will need to submit the Record of Employment (ROE) for each of the jobs listed above if it wasn’t already submitted by your employers. Your application will not be complete until all your ROEs are received. Your employers are bound to provide you with a copy of this document, either in digital or paper format. If you have a physical copy, you can bring it by hand or by mail to the Service Canada Centre where you belong.

Shortly after you submit your application, you’ll receive a letter with your EI benefit statement and A 4-digit access code to complete your reports online or by the telephone reporting service. You must complete bi-weekly reports to prove your eligibility and to receive benefits to which you may be entitled; failure to do so can mean a loss of benefits.

You can follow the progress of your application online in My Service Canada Account (MSCA). If your application is approved, you’ll receive payment of your first pension within 28 days. If your application is denied, you will be given an explanation. If you do not agree, you can request a reconsideration.

Please note: to get paid as quickly as possible, take a few minutes to review your direct deposit information in MSCA and update it if necessary.

We hope this article has been helpful and we wish you all the best in your job search!